Governor Pushing for Two-Month Sales Tax Holiday| 02:33PM / Wednesday, June 23, 2021 | |

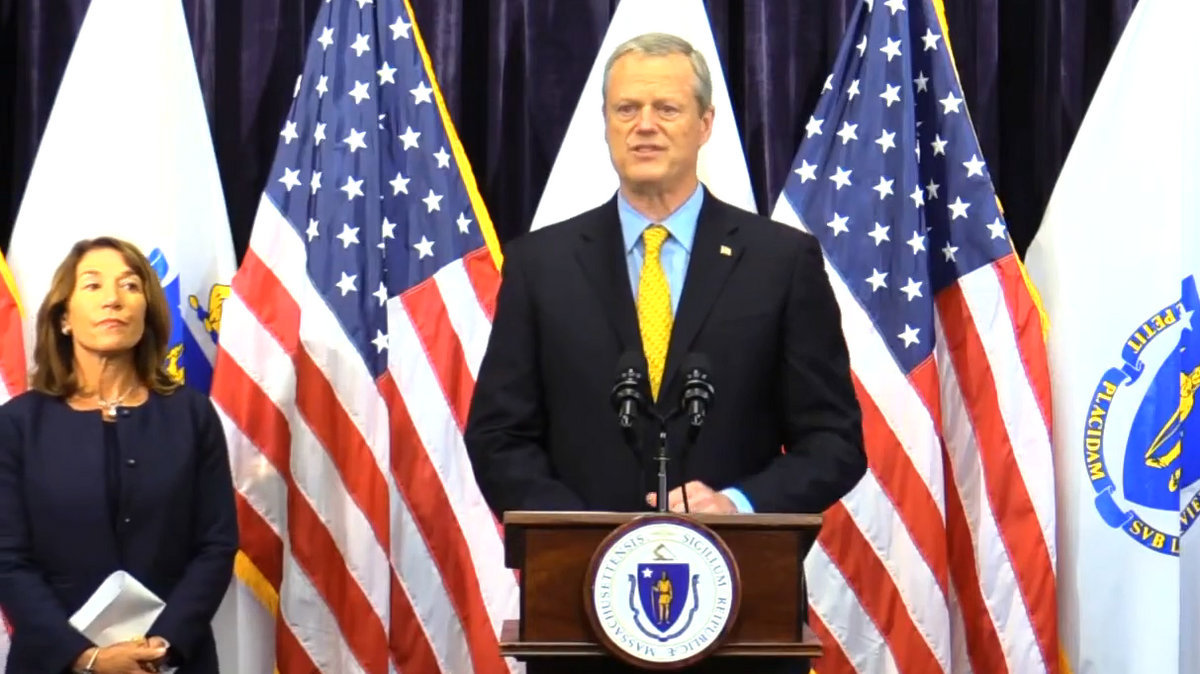

Gov. Charlie Baker announces plans for a sales tax holiday for the months of August and September. Gov. Charlie Baker announces plans for a sales tax holiday for the months of August and September. |

BOSTON — The governor is proposing a two-month-long sales tax holiday this year as a way to support local economies and that would put an estimated $900 million back into residents' pockets.

A sales tax holiday is already on the books for Aug. 14-16, a weekend of tax relief in August that's now a law in the state at this point. The Baker-Polito administration filed legislation on Wednesday to expand the sales tax holiday to the entire months of August and September.

"A two-month sales tax holiday will provide a boost to Massachusetts' taxpayers and Main Street economies as we continue to recover from COVID-19," said Gov. Charlie Baker on Wednesday in a statement. "Massachusetts' economic recovery is off to a good start, but it's crucial that the commonwealth takes action now to spur more economic activity in communities and support taxpayers. Thanks to stronger than expected tax revenues, the commonwealth has managed to grow the rainy day fund to a balance higher than it was at the beginning of the pandemic, and we can also afford to return these tax dollars to our residents and small businesses."

State tax revenues for fiscal 2021, he said, continues to "significantly exceed projections." Sales tax revenues to date are 14.9 percent above benchmark and revenues across the board means the state is poised to end the fiscal year with a significant surplus.

Baker at a press conference on Wednesday said tax revenues collections are $3.938 billion more than the year-to-date benchmark. Also, Massachusetts has been awarded significant federal resources since the start of the COVID-19 pandemic, including Coronavirus Aid, Relief, and Economic Security Act funding that has helped reduce pressure on the operating budget.

The state's rainy day fund is expected to grow by $850 million more than expected and now stands at about $4.4 billion more than when the pandemic started.

"The Massachusetts economic recovery is off to a good start. But we think this moment is a crucial one to make additional investments to help our local economies and our businesses," the governor said. "This proposal will help taxpayers keep more money in their pockets and encourage more people to shop locally. It will especially help lower income residents who are the most affected by the sales tax in the first place."

The holiday exempts retail items for personal use (up to $2,500 per item) from the state's sales tax of 6.25 percent. It does not include such items telecommunications, cars and boats, utilities and gasoline, meals, alcoholic beverages or marijuana.

"After this very tough year, our taxpayers and our small businesses all deserve a break," he said, later adding, "We urge our partners in the Legislature to act quickly on this fiscally responsible proposal to provide much needed tax relief to our residents and families and to our small businesses."

|

MEMBER SIGN IN

MEMBER SIGN IN

MEMBER SIGN IN

MEMBER SIGN IN